A year after Malkiel published his book, the Wall Street Journal decided to put his dart-throwing, monkey stock-picking idea to the test. I was disappointed to discover that they didn't actually perform the hilarious and potentially dangerous experiment of blindfolding monkeys and letting them launch darts...apparently WSJ staff members acted as the monkeys and threw darts at a list of stocks. As far as I can tell, they weren't actually blindfolded, but it least there were actual darts involved. After a hundred "fake monkey" contests, the WSJ published mixed results, which were widely debated.

Where am I going with all this? I guess reading all this made me realize that when it comes to saving for retirement, most people still go with the pros. Even though monkeys apparently have money management skills that rival those of their human counterparts, presumably at a much lower cost, investors still seek credibility when it comes to growing their life savings.

If you look some of the most well-known names in the financial industry, you'll notice a consistent pattern. The figureheads of most top financial companies are old, rich-looking white guys who fall into one of four broad categories: men who look like angry 19th century railroad tycoons, wealthy grandfather types, nerdy economists who had their lunch money stolen as children (a trend that I suspect continues in adulthood), or founding fathers of the United States.

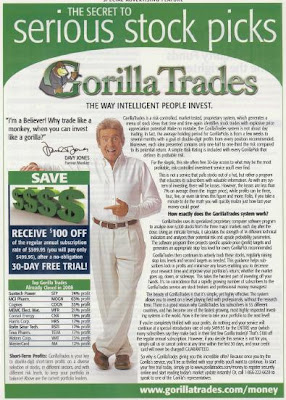

It's undeniable. It seems that people demand a certain level of credibility before they feel comfortable enough to hand over control of their savings. That's why I was shocked when I came across this ad in a 2008 issue of Money magazine:

It's undeniable. It seems that people demand a certain level of credibility before they feel comfortable enough to hand over control of their savings. That's why I was shocked when I came across this ad in a 2008 issue of Money magazine:

It's Gorilla Trades! The founders of this fine company must have taken Burton Malkiel's monkey stock-picking comments a bit too seriously. The credibility factor might feel a bit shaky at first, but for those finicky customers who have some initial reservations about handing over the financial reins to the bespectacled, cigar-smoking gorilla that appears in the company's logo, Davy Jones from the Monkees makes an appearance to offer his endorsement. And to top it off, his quote starts with, "I'm a Believer!", a not-so-subtle reference to The Monkees' #1 hit from the late 60s.

I guess on some level, I can understand how letting chimps manage your nest egg might make sense--if you're tired of lining your financial advisor's pockets with those hefty fees, why not let monkeys pick stocks for free? From the sounds of the Wall Street Journal study, they might even do a reasonable job. But the problem is, Gorilla Trades is not free. They offer a 30-day free trial, but apparently letting apes manage your portfolio requires a minimum $600 annual subscription.

I couldn't help but feel skeptical when I first saw the ad--despite the marketing clout of Davy Jones, could Gorilla Trades really attract subscribers and stay in business? I went to their website to see if the company was still around, three years after the ad appeared in Money. Sure enough, the website remains active, and my skepticism immediately vanished when I saw this:

Now I, too, am a believer. One thing's for sure--I don't need one of those fancy, "traditional" financial institutions to feel confident that I'll live comfortably in retirement. I don't care any more if my financial advisor works for a company founded by a guy who resembles Cornelius Vanderbilt. But there's a tough decision in my future. Celebrities are never wrong, and Davy Jones has never led me astray in past, but $600 a year to let a guy in a muppet custume and a velour business suit manage my finances gives me reason to think twice. So I guess it's either join Gorilla Trades, or start heading toward the zoo with a handful of darts and the business section.

No comments:

Post a Comment